How Much More Is the Average Cost of Utilities for a Home Compared to an Apartment?

When choosing between renting an apartment or buying a home, utility costs are often overlooked—but they can significantly impact your monthly budget. Homes typically have larger square footage, more rooms to heat or cool, and additional maintenance needs, which naturally increases utility expenses.

Below is a detailed breakdown to help you understand how utility costs differ between apartments and houses.

How Much More Is the Average Cost of Utilities for a Home Compared to an Apartment (Apartment Vs House)

|

Utility Type |

Apartment (Avg/Month) |

House (Avg/Month) |

|

Electricity |

$90 – $140 |

$150 – $250 |

|

Natural Gas |

$30 – $60 |

$60 – $120 |

|

Water & Sewer |

$30 – $50 |

$60 – $100 |

|

Trash |

Often Included |

$20 – $40 |

|

Internet |

$60 – $90 |

$70 – $110 |

|

Total Average |

$210 – $340 |

$360 – $570 |

On average, a house costs $150–$250 more per month in utilities than an apartment.

Why Homes Cost More to Power Than Apartments

1. Larger Square Footage

Houses are usually two to three times larger than apartments, requiring more energy to heat, cool, and light.

2. Less Shared Infrastructure

Apartments benefit from shared walls that help retain heat or cool air. Single-family homes lose more energy.

3. Yard & Exterior Maintenance

Outdoor lighting, irrigation systems, garages, and exterior outlets add extra electricity and water usage.

4. Older Utility Systems

Many houses—especially older ones—have outdated HVAC systems and insulation, leading to higher bills.

Utility Cost Breakdown by Category

Electricity

Air conditioning, heating, and appliance usage drive most electric costs. Homes with multiple floors or poor insulation see the biggest increase.

Water & Sewer

Lawn care, dishwashers, laundry machines, and outdoor hoses raise water usage significantly in houses.

Gas

Used mainly for heating, water heaters, and stoves. Larger homes require more energy to maintain consistent temperatures.

Internet & Cable

Costs are similar, but homeowners often pay for faster plans due to larger spaces and multiple devices.

How to Reduce Utility Costs in a Home

- Upgrade to energy-efficient appliances

- Install a smart thermostat

- Seal windows and doors

- Use LED lighting throughout the home

- Limit outdoor water usage

- Schedule HVAC maintenance yearly

These small steps can reduce utility bills by 10–25%.

Apartment vs Home: Which Is More Cost-Effective?

Apartments are typically more affordable month-to-month, especially for singles or small households. Homes, while more expensive to maintain, offer space, privacy, and long-term value.

Best for apartments:

- Lower upfront costs

- Predictable utility bills

- Minimal maintenance

Best for homes:

- Families or long-term residents

- Customizable living space

- Investment potential

Final Thoughts

If you’re deciding between an apartment and a house, expect to pay $1,800–$3,000 more per year in utilities for a typical single-family home. Understanding these costs helps you plan your budget accurately and avoid surprises after moving.

Categories

- Moving Abroad & International Relocation154

- Moving Tips & How To Guides120

- Moving Tips & Specialty Moving40

- Moving Tips & How-To Guides34

- Car Shipping & Auto Transport25

- Moving Tips & Cost Guides9

- Moving Tips & Relocation Advice5

- Moving Tips & How-To Guides5

- Relocation & Cost of Living Guides4

- Long-Distance Moving Guides3

- Moving Guides & Lifestyle3

- Moving Cost Guides3

- International Moving & Expat Living2

- Specialty Moving & Cost Guides2

- Moving Tips & How-To Guides2

- Moving Costs & Planning2

- Cost of Living & Moving Insights2

- Car Shipping & Moving Guides1

- International Moving Guides1

- Long-Distance Moving & Relocation Guides1

Recent posts

-

Is Buffalo a Good Place to Live? Pros, Cons & Cost of Living Explained?

January 2026 -

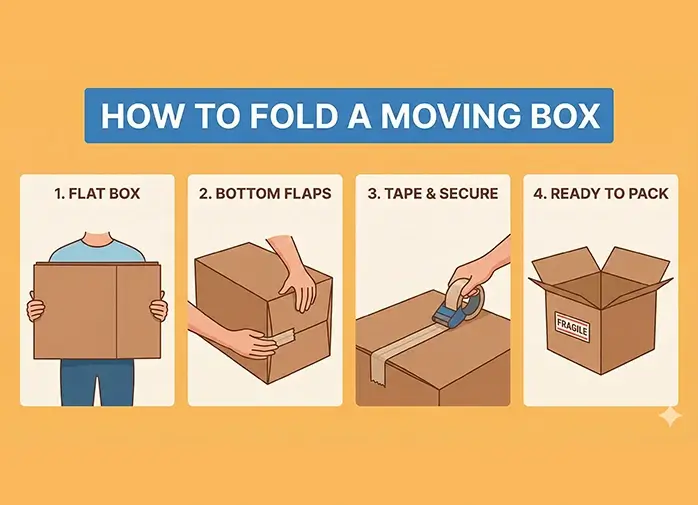

How to Fold a Box for Moving? Step-by-Step Packing Guide

January 2026 -

How Much More Is the Average Cost of Utilities for a Home Compared to an Apartment?

January 2026 -

How Much Do Movers Charge Per Mile? A Complete Cost Breakdown

January 2026

Local Movers

Local Movers Last-Minute Movers

Last-Minute Movers Junk Removal

Junk Removal Long Distance Movers

Long Distance Movers Piano Movers

Piano Movers Heavy Equipment

Heavy Equipment Commercial Movers

Commercial Movers Moving Container

Moving Container Car Transportation

Car Transportation Furniture Movers

Furniture Movers Truck Rental

Truck Rental Moving Cost Calculator

Moving Cost Calculator Moving Planner

Moving Planner Packing Calculator

Packing Calculator Moving Checklist

Moving Checklist Moving Insurance

Moving Insurance FAQ

FAQ Contact Us

Contact Us Moving Loan

Moving Loan About Us

About Us